American clergy concerned about the financial health of their flock, and laypeople who have been burned by the payday loan industry – which they allege does twice as much business as McDonald’s – are looking forward to the issuance of rules from the U.S. federal Consumer Financial Protection Board to rein in lenders.

In advance of a 2 June field hearing on payday lending in Missouri, Molly Fleming, a payday lending reform advocate with Communities Creating Opportunities, expressed her hope that the rules would be announced before the hearing.

Area pastors have been working on the payday lending issue since 2012, said Susan Schmalzbauer, a congregational co-ordinator for Faith Voices of Southwest Missouri.

Even though a statewide referendum slated for 2014 was thwarted by lenders, the clergy regrouped and said, “Hey, we want to work on this again,” Schmalzbauer told Catholic News Service in a 26 May phone interview.

“The beauty of predatory lending is that it’s not a red or blue issue, it is truly a purple issue,” she said. “We had religious leaders from across Springfield signing on to this letter. You wouldn’t expect their names to be on the same document. We had the head of the Assemblies of God, the pastor of one of the largest churches in Springfield, the Disciples of Christ. We had Catholics sign on.”

One of those Catholics was retired Bishop John J. Liebrecht of Springfield-Cape Girardeau. Another was Sr Katie Hoegeman of the Missouri-based Sisters of St Joseph of Carondelet.

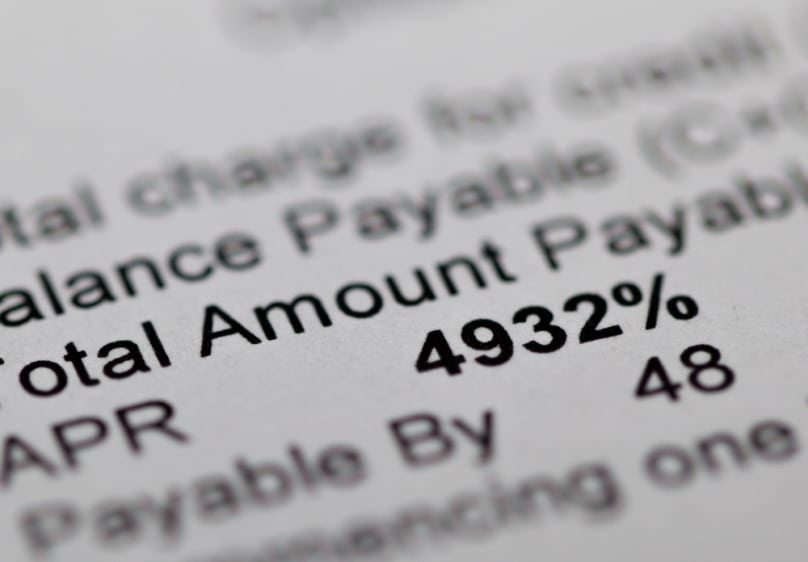

The Consumer Financial Protection Board is expected to announce rules, still subject to comment before they are enacted, that would put limits on the interest rates charged by payday lenders, car title loan outlets and similar nonbank lenders. Annual percentage rates of 300 per cent to 450 per cent are not uncommon. One pastor interviewed by CNS said some couples have divorced over the stress of being in perpetual debt to payday loan operations.

Ohio clergy are also active on the payday lending front.

Rev Carl Ruby, senior pastor of Central Christian Church, a nondenominational church, noted how the city’s population is declining. Springfield, after two straight decade-long population dips of 7.3 per cent, is now below its 1920 population level, and the Census Bureau’s 2014 estimate places the city at under 60,000. Yet the city is now home to 18 different payday lending outlets.

“Latino immigrants were being taken advantage of by payday lending centres. I was shocked by what I discovered. I was surprised that there were 18 of them. I was shocked to find the payday lending industry was bigger than McDonald’s” – $US47 billion for payday lending and rising, to $ US25.4 billion and shrinking for the hamburger chain,” Rev Ruby said.

“I felt we had a Christian duty to do something about it – responding to God’s call to take up the cause of the poor.”

Springfield’s city commissioners are “very interested” in taking on payday lending, Rev Ruby said, “but they don’t know where to start”. He can’t offer any guidance himself: “In terms of cracking down on them through zoning regulations, I’m not aware of any effort and I don’t even know where to begin the effort.”

At a recent community-wide, town-hall meeting on payday lending, Rev Ruby recalled the story of one man who “got into trouble with payday lending while he was in the military. It got to the point where he was suicidal, completely broke, and he couldn’t buy any groceries”. The man’s father had to bail him out of the “debt trap” his son had gotten into with the lenders.

Rev Ruby, who comes from an evangelical and fundamentalist background, told CNS, “We have a lot to learn from our Catholic brothers and sisters” when it comes to helping the poor. “I think the Catholic Church has put their focus on being the hands and feet of Jesus,” he said.

In Minnesota, Rev Billy G. Russell, president of the Minnesota State Baptist Convention and pastor of Greater Friendship Church in Minneapolis, with 1000 congregants, said this issue has energised his flock in a way that it hasn’t been since efforts to address the “achievement” gap between whites and minorities in public education.

Payday lending has been an issue since he took over the helm of the church 15 years ago. “We’d be trying to help as a church, bailing people out,” Rev. Russell said. “It got to the point we were bailing so many people out, we need a bailout ourselves.

He described the cycle of debt as “everything from car loans to loans paid out on the house, just trying to get the money to get from one week to another, trying to pay the light bill, the gas bill, get people back to work, not having a car to get back to work, then when they got the car loan and you realise you can’t pay it off and you got to give it (the car) up, and then you’re really messed up”,

His church is looking at starting a credit union to offer an alternative to payday lenders. “We’re talking with some small banks to help us out,” Rev Russell said. The state’s Baptists came up with a “jubilee situation” which is based on the Old Testament concept of a jubilee year in which debts are forgiven, he added, but “it’s helped just a small number of people so far. There’ so many (needing help) we don’t have enough to go around”.

In the Dallas-Fort Worth area, “we’ve been working with Faith in Texas, which is a multifaith, multicultural movement for social justice in the area that part of the PICO National Network”, said Rev Wes Helm, associate pastor of Spring Creek Community Church in Garland, Texas. PICO, founded by a Jesuit priest in Oakland, California, in 1972, and has tackled the payday lending issue.

“When we joined them, we bought that concern with us,” Rev Helm added. “Pretty much every congregation we talked to in our area had the same concern.”